Real Estate Crowdfunding: Opportunities and Risks

Real estate crowdfunding has emerged as a popular investment option, offering unique opportunities and inherent risks. This innovative approach allows individual investors to pool their resources to finance real estate projects, from residential properties to commercial developments. In this article, we explore the various aspects of real estate crowdfunding, including the potential benefits, the associated risks, and key considerations for investors.

Understanding Real Estate Crowdfunding

Real estate crowdfunding is a method of raising capital for real estate investments through online platforms. It enables multiple investors to contribute small amounts of money towards a specific real estate project. This collective investment approach makes it easier for investors to gain access to the real estate market without requiring large amounts of capital. Additionally, utilizing the Best CRM for Real Estate Investors can help manage and track your crowdfunding investments more efficiently.

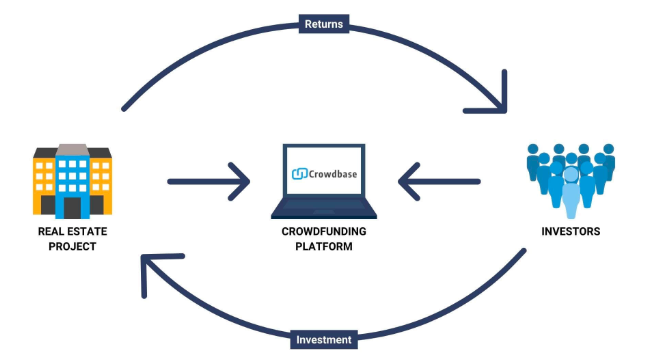

How Real Estate Crowdfunding Works

Real estate crowdfunding platforms connect investors with real estate developers or project sponsors. These platforms typically list various real estate opportunities, providing details about the project’s location, expected returns, timeline, and associated risks. Investors can choose projects that align with their investment goals and risk tolerance.

Types of Real Estate Crowdfunding

Real estate crowdfunding can be categorized into two main types: equity crowdfunding and debt crowdfunding.

Equity Crowdfunding

In equity crowdfunding, investors purchase shares in a real estate project, becoming partial owners of the property. Investors typically earn returns through rental income and the eventual sale of the property. This type of crowdfunding carries higher risk, but it also offers the potential for higher returns.

Debt Crowdfunding

Debt crowdfunding involves investors lending money to real estate developers or property owners. In return, investors receive regular interest payments over a fixed period. Unlike equity crowdfunding, debt crowdfunding does not provide ownership in the property, but it tends to offer lower risk and more predictable returns.

Opportunities in Real Estate Crowdfunding

Real estate crowdfunding presents several opportunities for investors, particularly those who may not have access to traditional real estate investments.

Accessibility to Real Estate Markets

One of the most significant benefits of real estate crowdfunding is the accessibility it offers. Traditionally, investing in real estate required substantial capital and expertise. Crowdfunding platforms have democratized real estate investment, allowing individuals with smaller budgets to participate in property markets.

Diversification of Investment Portfolio

Investors can diversify their portfolios by investing in various real estate projects across different locations and property types. This diversification can reduce risk by spreading investments across multiple assets, thereby mitigating the impact of any single project’s underperformance.

Potential for High Returns

Real estate investments, particularly equity crowdfunding, offer the potential for substantial returns. If a property appreciates in value or generates significant rental income, investors can benefit from these gains. Additionally, real estate has historically been a relatively stable and appreciating asset class, providing long-term growth opportunities.

Passive Income Generation

Real estate crowdfunding can be an attractive option for investors seeking passive income. Many crowdfunding projects involve rental properties, where investors can earn regular income without the need for active management. This passive income can be an excellent supplement to other earnings or retirement funds.

Participation in Real Estate Projects

Real estate crowdfunding allows investors to participate in large-scale real estate projects that would typically be out of reach for individual investors. These projects may include commercial developments, apartment complexes, or large residential communities. By pooling resources with other investors, individuals can take part in significant real estate ventures.

Risks of Real Estate Crowdfunding

Despite its many opportunities, real estate crowdfunding is not without risks. Investors should be aware of these potential pitfalls before committing their funds.

Illiquidity of Investments

Real estate investments, particularly those made through crowdfunding platforms, are often illiquid. This means that investors may not be able to easily sell their shares or withdraw their funds before the project reaches completion. The lack of liquidity can be a significant risk, especially if the investor needs access to their capital.

Market Fluctuations and Economic Downturns

Real estate values are subject to market fluctuations, and an economic downturn can negatively impact the value of crowdfunding investments. During a recession or housing market crash, property values may decline, and rental income may decrease, leading to lower returns or potential losses for investors.

Project-Specific Risks

Each real estate project carries its own set of risks. These can include construction delays, cost overruns, zoning issues, and difficulties in finding tenants or buyers. If a project faces significant challenges, it could result in lower-than-expected returns or even the loss of the invested capital.

Platform Risk

Investors should also consider the risk associated with the crowdfunding platform itself. If the platform goes out of business, investors may face difficulties recovering their funds or managing their investments. It’s essential to choose reputable and well-established platforms with a track record of success.

Regulatory and Legal Risks

Real estate crowdfunding is subject to regulatory oversight, which varies by country and region. Changes in regulations or legal challenges can impact the viability of crowdfunding investments. Investors should be aware of the legal framework governing real estate crowdfunding in their jurisdiction.

Potential for Lower-than-Expected Returns

While real estate crowdfunding offers the potential for high returns, it also comes with the risk of lower-than-expected outcomes. Factors such as unexpected expenses, lower rental income, or market conditions can all affect the profitability of an investment. Investors should be prepared for the possibility that their returns may not meet their initial expectations.

Key Considerations for Real Estate Crowdfunding Investors

Investors interested in real estate crowdfunding should carefully evaluate several factors before committing their funds. These considerations can help mitigate risks and improve the chances of a successful investment.

Due Diligence on Projects and Sponsors

Conduct thorough due diligence on the real estate projects and sponsors listed on crowdfunding platforms. Review the sponsor’s track record, the project’s financial projections, and any potential risks. Understanding the details of the investment is crucial for making informed decisions.

Understanding Investment Time Horizon

Real estate crowdfunding investments often have long time horizons, ranging from several years to over a decade. Investors should be comfortable with locking their capital for the duration of the project and understand that returns may not materialize until the project is completed or sold.

Assessing Risk Tolerance

Consider your risk tolerance before investing in real estate crowdfunding. Equity investments typically carry higher risks and the potential for higher returns, while debt investments offer more stability but lower returns. Choose investments that align with your risk appetite and financial goals.

Evaluating Platform Reputation

Choose crowdfunding platforms with a strong reputation and positive user reviews. Platforms with a proven track record and transparent operations are more likely to provide a secure investment environment. Research the platform’s fees, terms, and customer support to ensure they meet your needs.

Diversification Across Multiple Projects

To reduce risk, diversify your investments across multiple real estate projects. By spreading your capital across different properties and locations, you can minimize the impact of any single project’s underperformance. Diversification can enhance the overall stability of your investment portfolio.

Legal and Tax Considerations

Be aware of the legal and tax implications of real estate crowdfunding in your jurisdiction. Tax treatment of crowdfunding investments can vary, and it’s important to understand how your returns will be taxed. Consulting with a tax professional or financial advisor can help you navigate these complexities.

The Future of Real Estate Crowdfunding

The real estate crowdfunding industry has grown rapidly in recent years, and its future looks promising. As technology continues to advance and more investors become aware of this investment option, the market is expected to expand further.

Technological Advancements

Technological innovations, such as blockchain and smart contracts, have the potential to revolutionize real estate crowdfunding. These technologies can improve transparency, reduce transaction costs, and streamline the investment process, making it more accessible and efficient for investors.

Increasing Investor Participation

As more people become familiar with real estate crowdfunding, investor participation is likely to increase. This growing interest can lead to the development of more diverse and innovative real estate projects, offering even more opportunities for investors.

Regulatory Evolution

The regulatory landscape for real estate crowdfunding is likely to continue evolving. Governments and regulatory bodies may introduce new rules to protect investors and ensure the transparency of crowdfunding platforms. These changes could provide additional safeguards for investors while promoting the growth of the industry.

Global Expansion

Real estate crowdfunding is expanding beyond traditional markets, with platforms emerging in various countries around the world. This global expansion offers investors the opportunity to participate in real estate projects in different regions, further diversifying their portfolios.

Real Estate Crowdfunding vs. Traditional Real Estate Investment

Real estate crowdfunding differs significantly from traditional real estate investment methods, and understanding these differences is crucial for investors.

Lower Capital Requirements

One of the most significant differences is the lower capital requirements associated with crowdfunding. Traditional real estate investments often require substantial upfront capital, while crowdfunding allows investors to participate with smaller amounts, making real estate investment more accessible.

Passive vs. Active Management

Traditional real estate investment often involves active management, where investors are responsible for property maintenance, tenant management, and other day-to-day operations. In contrast, real estate crowdfunding offers a more passive investment approach, with professional managers handling the project’s operations.

Liquidity Considerations

Traditional real estate investments can be more liquid, especially in well-established markets. Investors can sell their properties or shares relatively easily. In contrast, real estate crowdfunding investments are typically illiquid, with investors unable to access their funds until the project is completed or sold.

Risk and Return Profiles

Both real estate crowdfunding and traditional real estate investment carry risks, but the risk profiles differ. Crowdfunding investments, particularly in equity projects, can be riskier due to factors like project-specific risks and platform reliability. Traditional real estate, while also risky, tends to offer more stability and predictability in returns.

Common Myths About Real Estate Crowdfunding

There are several misconceptions about real estate crowdfunding that investors should be aware of. Understanding the realities can help investors make informed decisions.

Read also: The Benefits of Professional Hotel Services

Myth: Crowdfunding is Only for Small Investors

While real estate crowdfunding is accessible to small investors, it is not limited to them. Institutional investors and high-net-worth individuals also participate in crowdfunding platforms, taking advantage of the opportunities they offer.

Myth: Real Estate Crowdfunding is Risk-Free

Like any investment, real estate crowdfunding carries risks. While it offers the potential for high returns, investors must be prepared for the possibility of losses, particularly in equity investments where market fluctuations can impact returns.

Myth: All Crowdfunding Platforms are the Same

Not all real estate crowdfunding platforms are created equal. Some platforms have better track records, offer more transparency, and provide better customer support than others. Investors should carefully research and choose platforms that align with their investment goals and risk tolerance.

Myth: Crowdfunding Always Offers High Returns

While real estate crowdfunding can offer high returns, this is not guaranteed. The returns depend on various factors, including the project’s success, market conditions, and the type of crowdfunding (equity vs. debt). Investors should set realistic expectations and understand that returns can vary widely.

Is Real Estate Crowdfunding Right for You?

Determining whether real estate crowdfunding is the right investment option depends on various factors, including your financial goals, risk tolerance, and investment horizon.

Financial Goals

Consider your financial goals when evaluating real estate crowdfunding. If you’re seeking long-term growth and are comfortable with the associated risks, equity crowdfunding may be suitable. If you’re looking for more stable, short-term returns, debt crowdfunding could be a better fit.

Risk Tolerance

Your risk tolerance is a critical factor in deciding whether to invest in real estate crowdfunding. If you have a higher risk appetite and are willing to accept the potential for losses in exchange for the possibility of higher returns, equity crowdfunding may be appropriate. Conversely, if you prefer lower-risk investments, consider debt crowdfunding or other investment options.

Investment Horizon

Real estate crowdfunding typically involves long-term investments, often ranging from several years to over a decade. Ensure that your investment horizon aligns with the project’s timeline and that you are comfortable with having your capital tied up for the duration.

FAQs

What is real estate crowdfunding?

Real estate crowdfunding is a method of raising capital for real estate investments through online platforms, allowing multiple investors to pool their resources to finance real estate projects.

How does real estate crowdfunding differ from traditional real estate investment?

Real estate crowdfunding typically requires lower capital, offers a more passive investment approach, and may involve higher risks compared to traditional real estate investment.

What are the main types of real estate crowdfunding?

The two main types of real estate crowdfunding are equity crowdfunding, where investors purchase shares in a project, and debt crowdfunding, where investors lend money in exchange for interest payments.

Is real estate crowdfunding safe?

Real estate crowdfunding carries risks, including market fluctuations, project-specific risks, and platform reliability. While it can offer high returns, investors must be prepared for the possibility of losses.

Can I sell my investment in a real estate crowdfunding project?

Real estate crowdfunding investments are often illiquid, meaning you may not be able to sell your shares or withdraw your funds before the project is completed.

How do I choose a real estate crowdfunding platform?

Choose a platform with a strong reputation, transparent operations, and a proven track record. Research the platform’s fees, terms, and customer reviews before investing.

Conclusion

Real estate crowdfunding offers a unique and accessible way for investors to participate in the real estate market. While it presents numerous opportunities, such as portfolio diversification and potential high returns, it also carries significant risks, including illiquidity and market fluctuations. By conducting thorough due diligence, assessing risk tolerance, and choosing reputable platforms, investors can navigate the complexities of real estate crowdfunding and make informed investment decisions. As the industry continues to evolve, real estate crowdfunding is likely to become an increasingly important component of the broader real estate investment landscape.